Welcome To The blogblog!

The Best in Blogging

Laptop Repair in Gilbert, AZ: Expert Restoring Your Device

Proficient laptop repair in Gilbert, Arizona, services await to breathe life back into your device, ensuring flawless functionality. Explore how these experts serve as your ultimate tech saviors.

Troubleshooting Laptop Problems: Holistic Repair in Gilbert

Confronting a malfunctioning laptop demands precise diagnosis as the initial step. In Gilbert, adept technicians leverage state-of-the-art diagnostic tools for accurate issue identification, guaranteeing efficient repairs and minimizing your device’s downtime.

Thorough assessments span both hardware and software, tackling not only symptoms but also root causes of performance issues. Opting for comprehensive repair services is an investment in the enduring health and optimal functionality of your laptop.

Fast and Dependable: Opting for Premier Laptop Repair in Gilbert

In a rapidly evolving world, time is precious. Recognizing the urgency of your tech requirements, Gilbert’s leading laptop repair specialists prioritize swift turnaround times, prompt restoration of your device ensures optimal condition.

Reliability is paramount in selecting a repair service. The finest laptop repair professionals in Gilbert utilize authentic parts and adhere to industry best practices. This dedication to quality guarantees not just immediate issue resolution but also safeguards against future complications.

Local Excellence: Gilbert’s Top Repair Specialists

Opting for local expertise brings a range of benefits. Gilbert’s top laptop repair specialists are embedded in the community, fostering a sense of accountability and personalized service. Moreover, local knowledge enables them to address common laptop issues prevalent in the Gilbert area.

Customer satisfaction is paramount for local repair services. Attention to detail, clear communication, and a commitment to exceeding expectations set Gilbert’s specialists apart. In addition, this approach ensures that every client receives tailored solutions to meet their specific laptop repair needs.

In entrusting your laptop to expert repair services in Gilbert, AZ, you are guaranteed a revitalized device with seamless functionality. From precise diagnostics to swift and reliable solutions, these professionals prioritize your tech well-being. Choose local excellence and experience the optimal revival of your laptop with Gilbert’s top repair specialists.

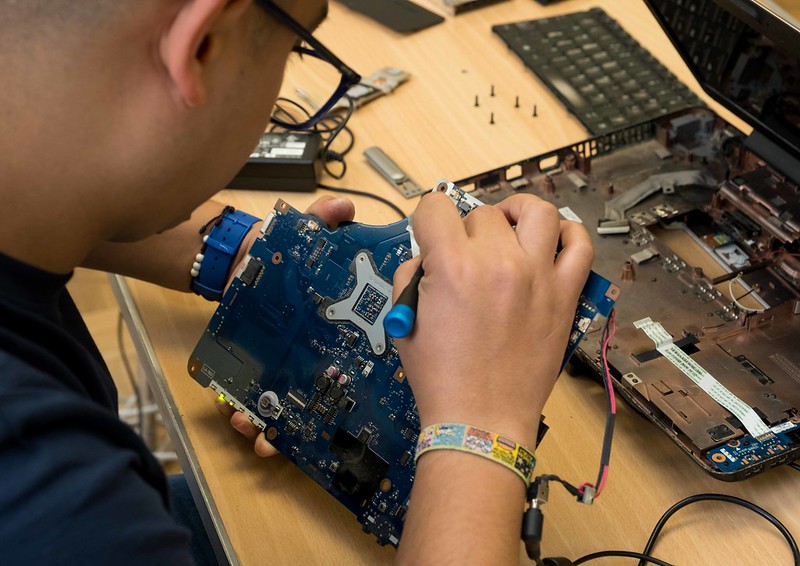

Computer Repair in Mesa AZ: Comprehensive and Seamless Solutions

In the heart of Mesa, Arizona, where the pace of life meets the speed of technology, finding reliable and efficient Computer Repair Mesa AZ is paramount. Your digital world may come to a standstill when your computer encounters issues, and that’s precisely where our dedicated team steps in, committed to providing unparalleled computer repair services tailored to Mesa residents.

Revealing Superiority in Computer Repairs Mesa AZ

Dealing with computer malfunctions is our specialty, positioning our team as the primary choice for exceptional services in Mesa, AZ. We comprehend the frustration that surfaces when your computer deviates from its expected performance, causing disruptions in both work and personal tasks. Hence, our all-encompassing computer repair services are meticulously crafted to promptly and smoothly return you to optimal functionality.

Premier Computer Repair Service in Mesa, AZ

What distinguishes us is our steadfast dedication to providing the foremost computer repair service in Mesa. Our proficient technicians excel in diagnosing and resolving a diverse range of computer issues, addressing everything from hardware glitches to software malfunctions. We emphasize efficiency without compromising on work quality, assuring you that your computer is entrusted to experts genuinely committed to restoring its optimal functionality.

Human-Centric Philosophy: Prioritizing Your Needs

Central to our service philosophy is a focus on people. We recognize that behind each malfunctioning computer is an individual with distinct needs and concerns. Our team invests time in listening and understanding your unique situation. This helps us deliver solutions that target the root cause of the issue.

Clear Service Pricing: What’s the Cost to Fix Your Computer?

A frequent inquiry we receive is, “How much does it cost to get a computer fixed?” We prioritize transparent and equitable pricing, ensuring awareness of the costs. Our dedication to transparency goes beyond computer repairs. We also strive to foster trust with our clients and provide information on service charges.

Deciphering Computer Repair Expenses

Comprehending the intricacies of computer repair costs may seem overwhelming. Yet, we dedicate our simplified processes for our clients. Our transparent pricing structure is crafted to be straightforward, free from hidden fees or unforeseen charges. Whether it’s hardware replacements or software upgrades, we furnish comprehensive explanations of the services provided and the associated costs.

Timely Restoration: Maximizing Productivity with Swift Turnaround

In our contemporary, fast-paced world, we grasp the significance of time. Our team is steadfast in minimizing downtime and elevating productivity. In addition, our computer repair services boast a prompt turnaround time, ensuring your device swiftly regains optimal performance. Additionally, understanding that each moment without your computer poses potential inconvenience, we strive for an efficient repair process to swiftly address your needs.

The Road to Seamless Computing in Mesa, AZ

A commitment to excellence, a people-centric approach, transparent pricing, and a swift turnaround time make a preferred choice for computer repair services in Mesa, AZ. When your computer faces challenges, trust search for an experienced team to provide solutions you need. It will not only fix the issue at hand but also enhance the overall performance of your device. Entrust your digital world is in capable hands. Always remember to choose dedicated computer repair services in Mesa.

Search Engine Optimization – Important Tips For a Successful SEO Campaign

Search engine marketing is a engrossing industry and can be very amusing. But I think most SEO Consultants would agree that there are many aspects of Search Engine Optimization that are difficult to understand at times even though you may have great experience in this field. Well this is not the review that would discuss all of those difficult aspects of SEO but the things that are easy to understand. FYI: Looking for a Great SEO in Phoenix, Arizona? Look up Local Search Technologies they are awesome to work with and can help you with your SEO marketing. Ok, back to business!

The first point that I think that is very easy to understand and this is called “keyword density”. This refers to the fact that the number of times a given keyword or a phrase appears in your web content as compared to the total number of words in the article is crucial and this is something that you should carefully consider. If you follow the guidelines set by the search engines you can be sure that your article would meet their criteria. This means more keywords and phrases. This can be a source of fun but it definitely should be done carefully since it can make all the difference when you appear in the search results.

The other thing that is very easy to understand, is “PageRank” from Google. PageRank is a number given to every page on the Internet and it is based on the total number of links that is points back to your webpage. The more links that point back to your page that is with high PageRank will be higher. In fact that would also be good for your search rankings because it would be better optimized. However if the links are with poor quality or not even PageRank would be relevant and you would appear in the search results.

It’s been a while since Google announced their newest algorithm updates and to be honest, it’s still an extremely murky issue.

The Google Algorithm update has affected SEO in different ways. Google’s latest changes involve more than just the number of backlinks to a website. In fact, it’s their new approach to counting back links that makes it interesting. This change also involves the ranking of the site and the number of links. The site’s overall quality has no importance whatsoever in Google’s latest update. That’s right folks – the quality of a website is no longer important to Google and all the back links to the website are now of no value. and in the search engines above your competitors. But it’s your competitors that will have your back links added to their site as Google’s.

The new way of counting back links is that each link to the site represents a vote for your site. A vote for your site when there are tens of thousands of people voting for the site that have only one back link to your site. A really good vote. Votes for your site means they like your back link. If the site has ten votes, it will always be given more authority by Google.

When Google first rolled out this change with Page notes in February they said it was a test to see how websites vote on others. But since then there’s been proof that it’s a real change and it’s not a test. The change has affected the way other SE’s count back links in their algorithm updates. And that’s now led to an influx of websites coming forward to say they have been affected by the back link algorithm change.

So how is this affecting you and your business?

As many have found out the change is a little more complex than just putting more back links on your site. Google has made a change to the way it calculates your site’s link value in its algorithm.

For example Google no longer looks at the number of people who like you back link to your site. In fact you only received a vote if you have a link to your site on another website that is popular enough with Google spiders. This means you will have more votes, but you will not receive more link authority.

This means for a new website and new link back, that the link will have to be counted as an individual vote. The other change was how Google counted anchor texts in anchor links. This is something Google wanted to remove the chance of manipulation. So for a new website or a new link back, the link was not going to be counted as an individual vote.

Now the question is what does this mean for webmasters now? The fact that you can no longer buy links just means it’s harder to create back links. For a new website or a new link you’re going to have to create the link organically. The fact that votes have been removed means it’s going to be a more difficult task for webmasters to get a higher PageRank. But the fact that a new website has to pay a little more attention to the number of votes to your links is a good thing.

What this means is that you can no longer get away with spamming the web. The search engines are getting smarter about how links are counted and they’re also getting harder to manipulate. In summary I think these are the aspects that can be important for you to understand.

The Power of SEO

SEO for small business is gaining huge traction these days. SEO is a process of optimizing your web page so your business can be located easily by your customers. The internet offers numerous opportunities for small business to capitalize. It not only provides jobs, but also helps customers find the products they need. If your business can be found on the internet, it can also be won. The key is to know the techniques for doing this and to optimize your web page so that it not only is found easily, but also found relevant. The search engine optimization professional will certainly create SEO methods as well as roadmaps to successfully market your website. Here is an SEO Company that provides SEO Services in Sacramento – take a look at the Sacramento SEO Services your business could utilize to generate more sales and customers.

In order to get listed on Google, Yahoo or MSN you need to use Search Engine Optimization. So what are you waiting for? Go ahead and find your small business on these search engines today. But wait, this is not all. You still need to know the best techniques for running a successful business, right? Of course, we’re talking about getting customers and earning profits. These techniques may not be what you’re thinking. Let’s look at some of the practical aspects you need to make sure you do not miss.

The Search Engine is not dead!

People often forget about this one. They get worked up over there sites not being in the front page, but they do not concentrate on the fact that their competitors sites will be there in a heartbeat. And when you’re listed in the other search engines, they may vanish within days. So don’t get discouraged. Remember what Google said, “the fastest search engine is the one that’s listed first”.

The best practices are there for you to follow and know. Google offers more methods to optimize your website. This includes Google webmaster tools. For instance, if you set up Google tags, you’ll be notified in Google analytics, but it also alerts you via email if the custom tags aren’t set up, that can help your ranking as well. And if you’re using WordPress, you can add hooks that will give you a heads up.

The only way to get your website listed is by good practices, by great marketing practices. And these are great for your website. You must follow these tips if you want your site to be found. There’s no doubt about that. This will definitely boost your ranking in the eyes of the spiders that crawl all over the web. And when you’re listed in a prominent spot, your clients will be able to find you as well. It may not be instant, but it will happen sooner than if you’re not. So it’s worth spending a little extra on search engine optimization. You’ll get to use a powerful tool that will help you build and strengthen your client base.

A Dreamweaver or Frontpage Website

Web design and marketing strategy work together and inform customers with great design.

Good website design will also generate leads for a company. It is the first impression that will be long lasting and good websites will generate more leads and more money than the ones that are not well designed.

If you own a business and you are having a company website designed by a web design company then you need to know what you are doing first before proceeding with the designing process.

It is a long drawn process and your job is to make sure that the design that you get by doing the design work should be well designed from the first frame. The design should be well composed and balanced. The website should have easy navigation so that visitors can browse through the website easily.

If the website has a lot of information then visitors should be able to easily browse through the site and find the products that they are looking for. If you already have a website then you need to make sure that you can upload the new content in the site and make sure that the entire process should be automated, otherwise it will take more time then necessary.

The overall design of a website makes a great first impression of a site and your website will stay for a long time with the different color of the different backgrounds. The main background should be white or light blue depending on the company. I used to advise always to use a light blue or white background as most of the visitors to your site will be viewing on white or light blue backgrounds.

You need to change the colors as per your customers preferences but you should use light blue and or white if you are starting your business website and if you own a company with several products then you need to use dark blue and or black if you are starting your company website.

The colors should match the products so that all the products are identified. Always use light blue and white for products and dark blue and black for companies. You can use any combination of colors but the colors should match if you are starting a website for a company and the colors should be either white or light blue.

Remember that no matter what your business is you need to be able to make the various pages of your website look attractive and the pages should be well categorized. If you are using Dreamweaver or Frontpage then you need to assign the different templates to different folders.

Don’t forget you’ll also want a SEO marketing campaign to go along with your social media marketing as well. A reputable SEO company we can recommend is Local Search Technologies although based out of Phoenix, Arizona they cater to a National Customer base. They also work along some of the best design professionals in the industry.

Our Latest Posts

Laptop Repair in Gilbert, AZ: Expert Restoring Your Device

Proficient laptop repair in Gilbert, Arizona, services await to breathe life back into your device, ensuring flawless functionality. Explore how these experts serve as your ultimate tech saviors. Troubleshooting Laptop Problems: Holistic Repair in Gilbert Confronting...

Computer Repair in Mesa AZ: Comprehensive and Seamless Solutions

In the heart of Mesa, Arizona, where the pace of life meets the speed of technology, finding reliable and efficient Computer Repair Mesa AZ is paramount. Your digital world may come to a standstill when your computer encounters issues, and that's precisely where our...

Search Engine Optimization – Important Tips For a Successful SEO Campaign

Search engine marketing is a engrossing industry and can be very amusing. But I think most SEO Consultants would agree that there are many aspects of Search Engine Optimization that are difficult to understand at times even though you may have great experience in this...

The Power of SEO

SEO for small business is gaining huge traction these days. SEO is a process of optimizing your web page so your business can be located easily by your customers. The internet offers numerous opportunities for small business to capitalize. It not only provides jobs,...

A Dreamweaver or Frontpage Website

Web design and marketing strategy work together and inform customers with great design. Good website design will also generate leads for a company. It is the first impression that will be long lasting and good websites will generate more leads and more money than the...

SIGN UP FOR OUR NEWSLETTER & KEEP IN THE KNOW!